A Geoeconomic Tsunami

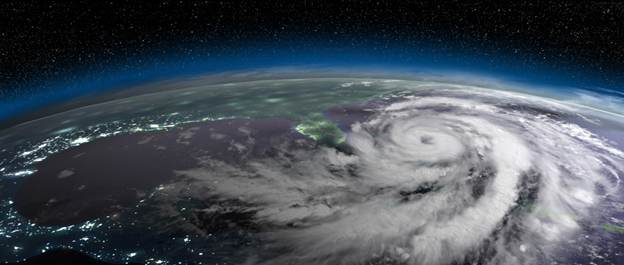

BERLIN, Mar 02 (IPS) - When tectonic plates shift, the earth shakes. Tsunamis race around the globe in the form of shock waves. The global economy has experienced three such earthquakes in recent years. The Covid-19 pandemic has made us aware of the vulnerability of a globally integrated economy.

When important components are stuck in quarantine in China, production lines in Germany come to a halt. Thus, in the organization of global supply chains – which for decades have been trimmed down for efficiency (‘just in time’) – resilience (‘just in case’) will play a more important role in the future.

After the end of the unipolar moment, larger and smaller powers are vying for the best positions in the new world order. In the hegemonic conflict between China and the United States, the government under Joe Biden has verbally disarmed, but its export controls in the high-tech sector have all the more bite.

This politicizes the framework conditions for investment decisions. Market access, infrastructure projects, trade agreements, energy supplies and technology transfers are more and more being evaluated from a geopolitical point of view.

Companies are increasingly faced with the decision of choosing one IT infrastructure, one market and one currency system over the other. The major economies may not decouple from each other across the board, but diversification (‘not all eggs in one basket’) is gaining momentum, especially in the high-tech sector. As this develops, we cannot rule out the possibility that economic blocs will form.

The experience with the ‘human uncertainty factor’ in the pandemic is also resulting in the acceleration of digital automation. Robots and algorithms make it easier to protect against geopolitical risks.

In order to bring these vulnerabilities under control, the old industrialized countries are reorganizing their supply chains. It remains to be seen whether this is purely for economic or logistical reasons (re-shoring or near-shoring), or whether geopolitical motives also play a role (friend-shoring).

Bloc formations

China must respond to these challenges. The fate of the People’s Republic will depend on whether it succeeds in charging to the head of the pack in worldwide technology, even without foreign technology and know-how. Anyone who believes that Beijing has no countermeasures up its sleeve will soon be proven wrong.

In order to compensate for the closure of the developed export markets, the Silk Road Initiative has been opening up new sales markets and raw material suppliers for years. At the last party congress, the Chinese Communist Party officially approved a reversal of its development strategy.

From now on, the gigantic home market will be the engine of the ‘dual circular economy’. Export earnings are still desired, but strategically they are being relegated to a supportive role.

One impetus behind China’s massive build-up of gold reserves serves is the goal of having its own (digital) currency take the place of the US dollar as the world’s reserve currency. Because China benefits more than anyone else from open world markets, it is continuing to rely on a globally networked world economy for the time being. Alternatively, Beijing could also be tempted to create its own economic bloc.

The foundations for this have already been put into place, with the Regional Comprehensive Economic Partnership (RCEP), the BRICS Development Bank (NDB), the Asian Infrastructure Investment Bank (AIIB), the Silk Road Initiative (BRI) and bilateral cooperation in Africa, Latin America and the Middle East.

The difficulties that Western companies face in the Chinese market should provide just a sample of what is looming if China makes market entry into such a bloc contingent on good political will.

But it is not just China. Generally, for all of Asia as the new center of the world economy, these geoeconomic disruptions are tantamount to a tsunami. And the disruptions could hit developing countries particularly hard.

Whether they are being cut from global supply chains for the sake of resilience or due to geopolitical factors, this brings equally devastating results. Of course, some economies are hoping to benefit from the diversification strategies of developed countries (i.e. the ‘China plus one’ strategy).

But digital automation neutralizes what is often their only comparative advantage – cheap labor costs. Why should a European medium-sized company have to deal with corruption and power cuts, quality problems and sea routes lasting weeks, when the robots at home produce better and cheaper?

Algorithms and artificial intelligence are also likely to replace millions of service providers in outsourced back offices and call centers. How are developing countries supposed to feed their (sometimes explosively) growing populations if, in the future, simple jobs are to be performed by machines in industrialized countries? And what do these geoeconomic disruptions mean for the social and political stability of these countries?

As with Europe, most Asian states depend on China’s dynamism for their economic development – and on the guarantees of the US for their security. Therefore, to varying degrees, they resist pressure to choose sides.

Whether it will be possible to escape the pull of geoeconomic bi-polarization over the long term, however, is still an open question. If the splitting of IT infrastructures continues, it could be too costly to play in both technological worlds.

American regulations prevent products with certain Chinese components from entering the market; but those who want to play on the Chinese market will not be able to avoid a steadily increasing share of Chinese components.

Reducing economic vulnerabilities through diversification

This type of global economy would also pose an existential challenge to export nations such as Germany. Even the short-term cutting off of Russian energy is a Herculean task. Decoupling from China at the same time seems difficult to imagine. But burying one’s head in the sand will not be enough.

Neither nations nor businesses will be able to escape the pressure from Washington and Beijing. In the future, important economic, technological, and infrastructural decisions will increasingly be subject to geopolitical considerations. Therefore, reducing one-sided vulnerabilities through diversification is the right thing to do.

On the other hand, some of the lessons drawn from the over-reliance on Russian energy before the war seem short-sighted. For decades, the German economy has integrated itself more deeply into the world economy than many other countries, with the goal of avoiding violent conflicts through interdependence.

It cannot break out of these interdependencies from one day to the next. Reducing economic vulnerabilities through diversification is therefore the right move, while decoupling for ideological reasons is the wrong one. Germany should therefore beware of sacrificing its economic future to an overly ambitious value-based foreign policy.

This is because losses of prosperity translate into fears of the future and social decline at home – a fertile breeding ground for right-wing populists and conspiracy theorists.

The geopolitical race, digital automation and the reorganization of supply chains according to resilience criteria are mutually reinforcing processes. It is not only companies that have to rethink their business models – entire national economies need to adapt their development models in order to be able to survive in a rapidly changing global economy.

The particular difficulty lies in having to make investment decisions today without being able to foresee exactly what the world of tomorrow will look like. Looking into the crystal ball, some think they can see an age of de-globalization. And in fact, in the wake of the 2008 financial crisis, the peak of globalization, as measured by the volume of world trade and capital exports has already passed.

However, de-globalization is not synonymous with a relapse into autarkic national economies. A stronger regionalization of the more networked global economy is more likely. In view of the political, social and cultural upheavals of turbo-globalization, this need not be the worst of possible outcomes.

One thing is certain: A geoeconomic tsunami will roll around the globe, crushing old structures in its path. The hope is that out of the ‘creative destruction’ that Joseph Schumpeter spoke of, there will emerge a more resilient, sustainable and diversified global economy.

However, without political shaping of the new world economic order, the opposite could also occur. Politically, this means adapting the rule-based world order so that it remains a stable framework for an open world economy because even the organization of a regionalised world economy needs global rules of the game that everyone adheres to.

Therefore, with few exceptions, nearly all nations have a great interest in the functioning of rules-based multilateralism. However, in the Global South, there is already a great deal of distrust towards the existing world order.

In reality, according to some, this amounts to the creation of the old and new colonial powers, whose supposedly universal norms do not apply to everyone but are instead violated at will by the permanent members of the UN Security Council.

In order to break through current blockages, such as those of the World Trade Organization (WTO), the emerging powers must be granted representation and a voice in the multilateral institutions that would be commensurate with their newfound importance.

Europe will have to accept a relative loss of influence because, as a rule-based supranational entity, its survival and prosperity depend on an open, rule-based world (economic) order.

Instead of morally elevating itself above others, Europe must concentrate all its energies on maintaining the conditions for the success of its economic and social model. In order to prevent the regionalization of the world economy from turning into the formation of competing blocs with high prosperity losses for everyone, there is a need for new partnerships on an equal footing beyond the currently popular comparisons of democracies and autocracies.

In order for new trust to develop, the global challenges (climate change, pandemics, hunger, migration) that particularly affect the Global South must finally be tackled with determination.

Marc Saxer coordinates the regional work of the Friedrich-Ebert-Stiftung (FES) in the Asia Pacific. Previously, he led the FES offices in India and Thailand and headed the FES Asia Pacific department

Source: International Politics and Society (IPS)-Journal published by the International Political Analysis Unit of the Friedrich-Ebert-Stiftung, Hiroshimastrasse 28, D-10785 Berlin

IPS UN Bureau

Follow @IPSNewsUNBureau

Follow IPS News UN Bureau on Instagram

© Inter Press Service (2023) — All Rights Reserved. Original source: Inter Press Service

Where next?

Browse related news topics:

Read the latest news stories:

- Turning the Tide on Tuberculosis: Ensuring Access, Treatment, and Prevention for All Communities Friday, March 21, 2025

- The Toll of Mental Health in Conflict Areas Friday, March 21, 2025

- Food Security and Water, a Priority for Border Towns in Central America Friday, March 21, 2025

- A Weapon in the Fight for Water Security: Preserving the Glaciers Friday, March 21, 2025

- Glaciers Of The SADC Region – A Wake-Up Call For Climate Action Friday, March 21, 2025

- How Rare Rhino, Tiger Conservation Has Locked Out Indigenous Communities Friday, March 21, 2025

- Award Winning Women Goat Herders in Chile Confront Climate Change Friday, March 21, 2025

- How Aid Cuts Will Shatter Global Water and Sanitation Progress Friday, March 21, 2025

- UNICEF condemns looting of lifesaving supplies for children in Sudan Friday, March 21, 2025

- ‘The poison of racism continues to infect our world’, Guterres warns on International Day Friday, March 21, 2025

Learn more about the related issues: